We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

New to Zacks? Get started here. Valves

Don't Know Your Password?

Don't Know Your Password?

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

WMB Quick QuoteWMB SUN Quick QuoteSUN MUSA Quick QuoteMUSA

You follow Analyst Blog - edit

You follow Nilanjan Choudhury - edit

U.S. oil prices edged up on Wednesday, following global trade worries arising out of vessel attacks in the Red Sea, believed to be by Yemen's Houthi rebels. However, gains were capped by a weekly report from the Energy Information Administration ("EIA") that showed builds in crude and fuel stockpiles. On the New York Mercantile Exchange, WTI crude futures gained 28 cents, or 0.4%, to close at $74.22 a barrel yesterday. We believe that oil’s current levels of below $70 allow long-term-oriented market participants to buy shares in quality companies at attractive prices. Investors interested in the sector could benefit from having quality stocks like Murphy USA (MUSA Quick QuoteMUSA - Free Report) , The Williams Companies (WMB Quick QuoteWMB - Free Report) and Sunoco LP (SUN Quick QuoteSUN - Free Report) in their portfolio. Let's dig deep into EIA’s Weekly Petroleum Status Report for the week ending Dec 15.

Crude Oil: The federal government’s EIA report revealed that crude inventories rose 2.9 million barrels compared to analyst expectations of a 2.5 million-barrel increase. The higher-than-expected stockpile gain with the world’s biggest oil consumer was largely thanks to bumper domestic production, which, at 13.3 million barrels per day, is the most on record. This more than offset the effects of strong demand and higher exports. Total domestic stock now stands at 443.7 million barrels — 6.1% above the year-ago figure of 418.2 million barrels but 1% less than the five-year average. The latest report also showed that supplies at the Cushing terminal (the key delivery hub for U.S. crude futures traded on the New York Mercantile Exchange) gained 1.7 million barrels to 32.5 million barrels — the highest since August. Meanwhile, the crude supply cover decreased from 27.6 days in the previous week to 27.4 days. In the year-ago period, the supply cover was 25.6 days. Let’s turn to the products now. Gasoline: Gasoline supplies increased for the fifth successive week. The 2.7 million-barrel rise was primarily attributable to higher production and weaker demand. Analysts had forecast that gasoline inventories would gain 700,000 barrels. At 226.7 million barrels, the current stock of the most widely used petroleum product is a mere 0.3% more than the year-earlier level, while it is 2% below the five-year average range. Distillate: Distillate fuel supplies (including diesel and heating oil) rose for the fourth time in as many weeks. The 1.5 million-barrel increase mainly reflected lower exports and an increase in imports. Meanwhile, the market looked for a supply build of 700,000 barrels. Following last week’s addition, current inventories — at 115 million barrels — are 4.1% below the year-ago level and 10% lower than the five-year average. Refinery Rates: Refinery utilization, at 92.4%, rose 2.2% from the prior week.

Having gone through the Weekly Petroleum Status Report, investors interested in the energy space might consider the operators mentioned below. Each of these companies currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Murphy USA: Murphy USA beat the Zacks Consensus Estimate for earnings in two of the trailing four quarters and missed in the other two. It has a trailing four-quarter earnings surprise of 7%, on average. Murphy USA is valued at around $7.7 billion. The company has seen its shares gain 23.1% in a year. The Williams Companies: WMB beat the Zacks Consensus Estimate for earnings in each of the last four quarters. Williams has a trailing four-quarter earnings surprise of 13.7%, on average. WMB is valued at around $42.7 billion. Williams has seen its shares gain 6.4% in a year. Sunoco LP: The 2023 Zacks Consensus Estimate for SUN indicates 10.9% year-over-year earnings per unit growth. Sunoco is valued at around $5.9 billion. SUN has seen its units rise 40.6% in a year.

Williams Companies, Inc. (The) (WMB) - free report >>

Sunoco LP (SUN) - free report >>

Murphy USA Inc. (MUSA) - free report >>

Our experts picked 7 Zacks Rank #1 Strong Buy stocks with the best chance to skyrocket within the next 30-90 days.

Recent stocks from this report have soared up to +178.7% in 3 months - this month's picks could be even better. See our report's 7 new picks today - it's really free!

Privacy Policy | No cost, no obligation to buy anything ever.

This page has not been authorized, sponsored, or otherwise approved or endorsed by the companies represented herein. Each of the company logos represented herein are trademarks of Microsoft Corporation; Dow Jones & Company; Nasdaq, Inc.; Forbes Media, LLC; Investor's Business Daily, Inc.; and Morningstar, Inc.

Copyright 2024 Zacks Investment Research | 10 S Riverside Plaza Suite #1600 | Chicago, IL 60606

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.04% per year. These returns cover a period from January 1, 1988 through December 4, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Visit Performance Disclosure for information about the performance numbers displayed above.

Visit www.zacksdata.com to get our data and content for your mobile app or website.

Real time prices by BATS. Delayed quotes by FIS.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.

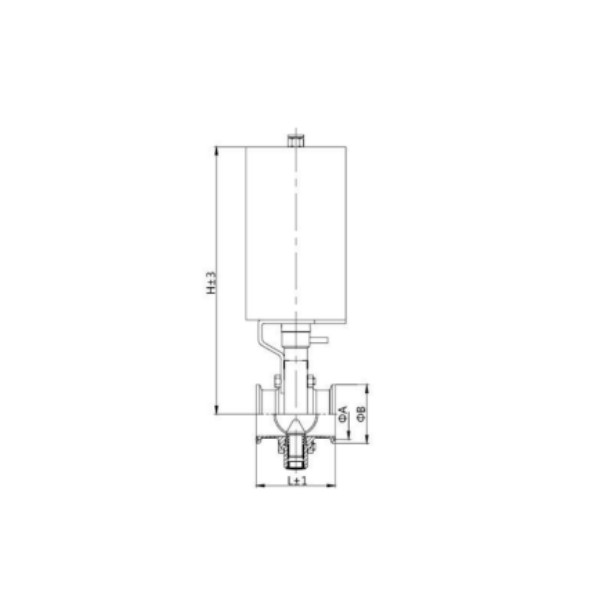

Sanitary Butterfly Valve This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.